Clipped: AI-Powered Call Coaching Platform

Complete Proposal

Executive Summary

Date:January 2026

Status:24-Month Integrated Roadmap

Total Investment:$336, 000(Year 1, Risk-Adjusted)+$178, 500(Year 2)

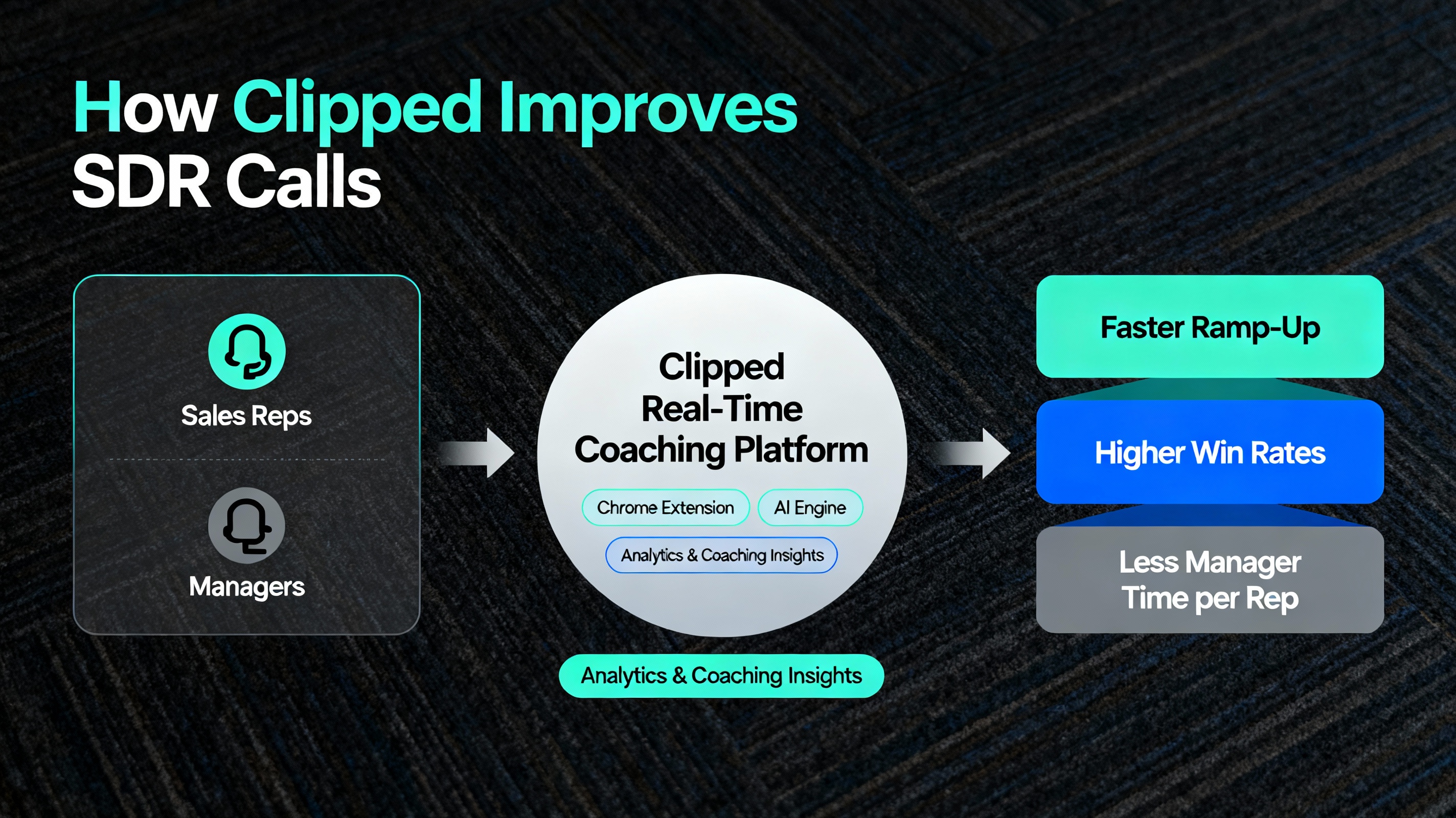

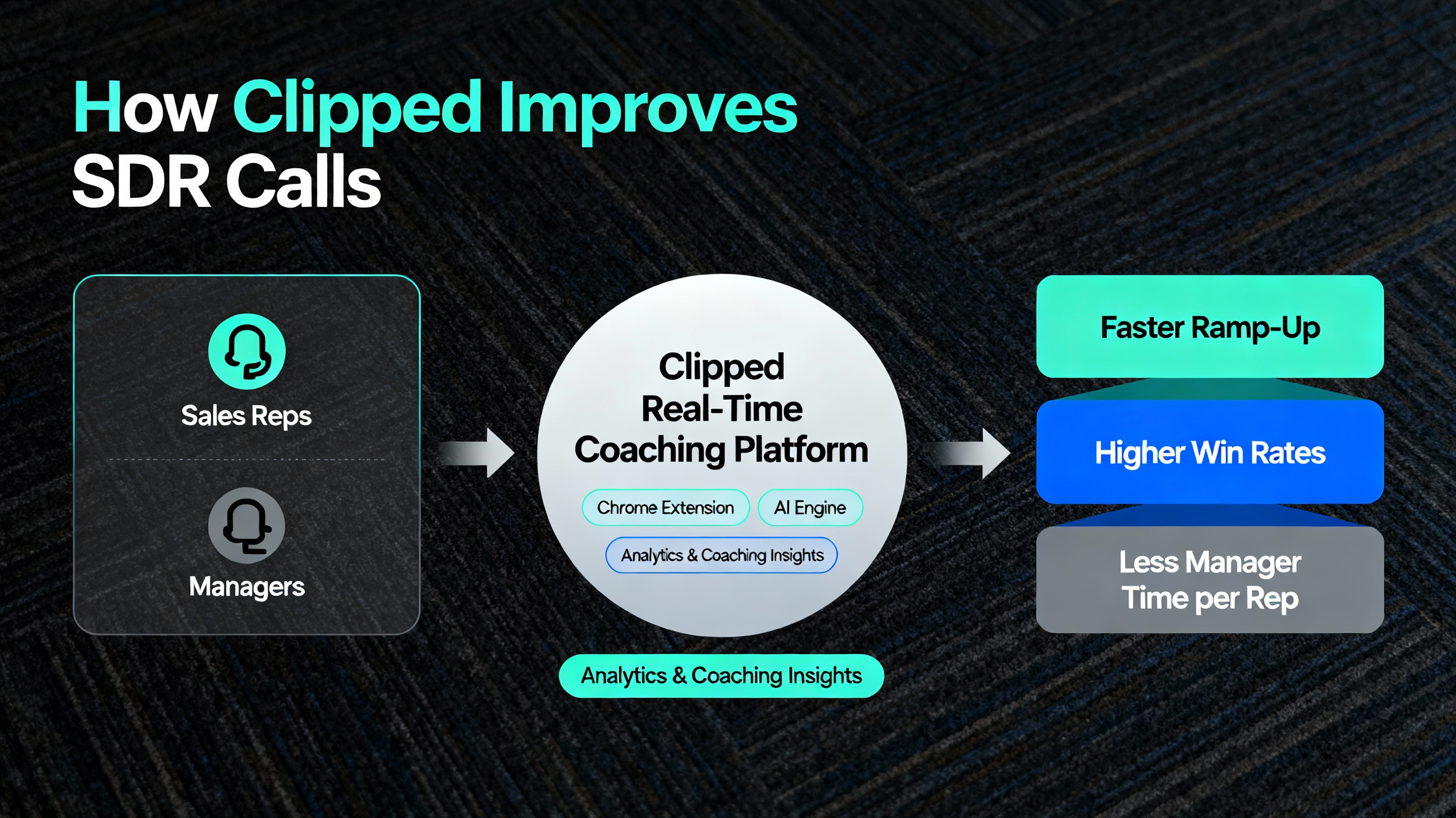

Clipped is a technically feasible, strategically positioned AI-powered call coaching platform designed for sales development representatives (SDRs). This comprehensive proposal extends beyond technical architecture to address critical business, and compliance gaps that determine success in competitive SaaS markets.

Key Outcomes:

- Technical:MVP delivery in 16 weeks with production-ready architecture

- Business:$120kARR Year 1 (conservative) → $600kYear 2 → $1.8MYear 3

- Operational:Fully staffed support, compliance, and customer success infrastructure

- Financial:Break-even by Month 18. Investment includes ~$100k safety bufferfor risk mitigation.

Year 1 customer and revenue targets.Clipped will pursue a conservative target of 5 paying customers by December 2026, representing approximately $120kin ARRbased on a blended seat price of $1, 600per rep per yearand an average of 15 seats per customer. The financial model also includes base (10 customers, $200k ARR)and optimistic (15 customers, $300k ARR)scenarios used for sensitivity analysis and investor conversations, but the plan of record for execution is the 5‑customer conservative scenario.

PART 1: STRATEGIC FOUNDATIONS

1.1 Customer Discovery & Market Validation

Objective:Validate product-market fit before committing full development budget.

Action Plan (Weeks 1-3):

| Activity | Owner | Deliverable | Success Metric |

|---|---|---|---|

| Qualitative Interviews | Mira | 15-20 SDR manager/founder interviews | 80%+say "would use" at $1, 500/seat/year |

| Competitive Positioning Analysis | Mira | Competitive matrix (Gong, Chorus, Orum, Ringcentral) | Clear differentiation identified |

| Pricing Willingness Survey | Mira | Pricing survey (freemium, seat, per-call models) | Consensus on preferred model |

| Pilot Customer Outreach | Mira | 10 LOIs (Letter of Intent) signed for $500/month pilot | 10 confirmed pilots ready |

| Market Size Estimation | Mira | TAM/SAM/SOM analysis | Addressable market validated |

Interview Questions:

- "How much would you pay for real-time call coaching?"

- "What features matter most: live prompts, post-call summaries, or team analytics?"

- "Would you choose Clipped over Gong for this price point?"

- "What integrations are non-negotiable? (Salesforce, Dialpad, HubSpot?)"

- "What's your biggest objection to adopting a new tool?"

Timeline:Complete by January 20, 2026(Shifted from Dec 2025)

Budget:$0(internal time)

Recommended Pricing Structure:

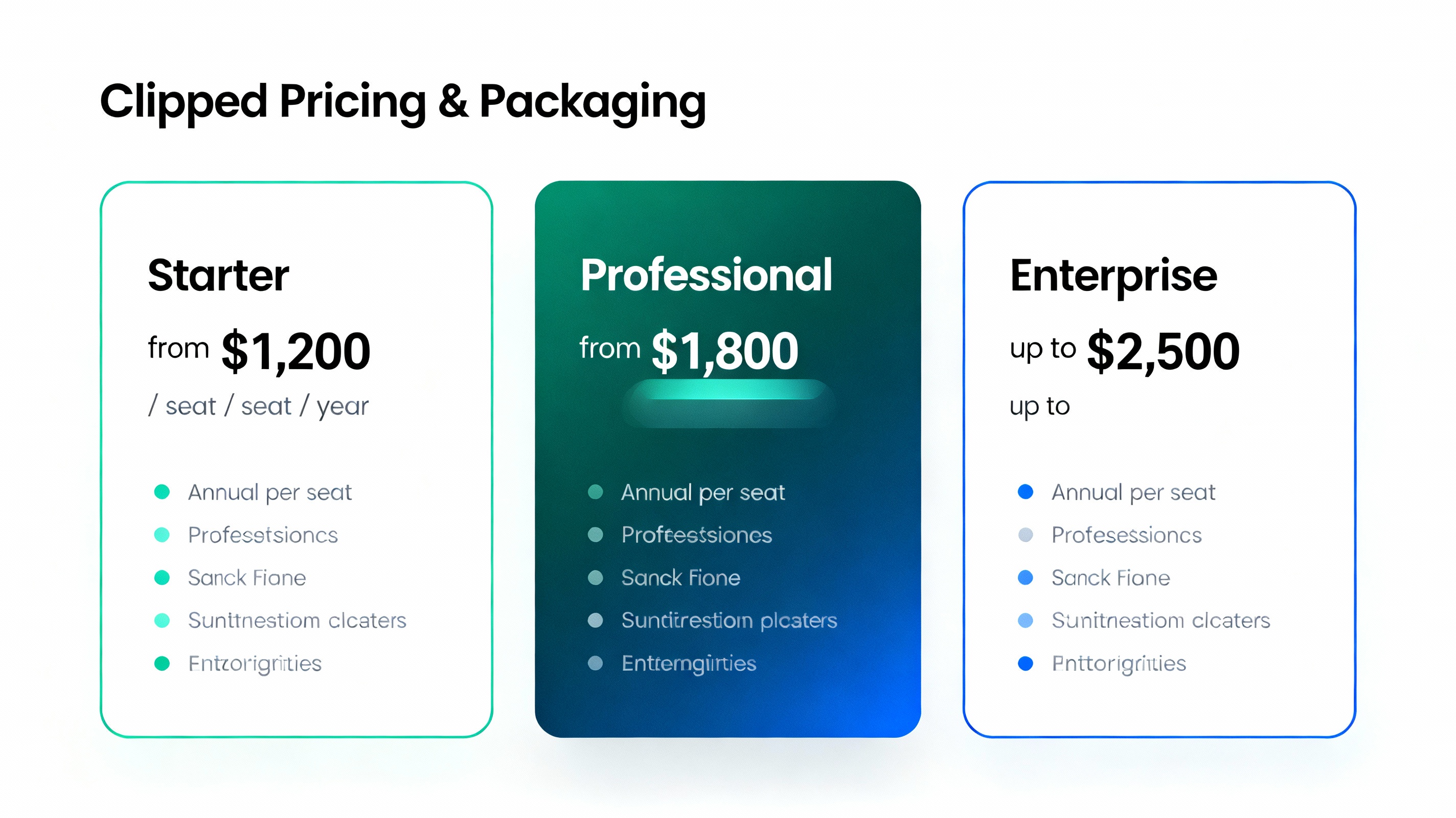

| Tier | Price/Seat/Year | Features | Target Customer |

|---|---|---|---|

| Starter | $1, 200 | Live prompts, basic post-call summaries, single Dialpad integration | Small SDR teams (5-10 reps) |

| Professional | $1, 800 | +Team analytics, manager dashboards, Salesforce integration, Deepgram audio quality | Growing teams (10-50 reps) |

| Enterprise | $2, 500+ | +Custom integrations, HubSpot/Kasper, dedicated support, SLA guarantees | Large enterprises (50+ reps) |

Unit Economics (Conservative Model):

- Annual revenue per customer: $1, 500(average across tiers)

- Gross margin: 75% (after AI/STT/hosting costs)

- CAC (Customer Acquisition Cost): $5, 000

- LTV (Lifetime Value): $18, 000(5-year contract)

- LTV:CAC Ratio: 3.6x ✅ (healthy; >3:1 required)

- Payback Period: 10 months ✅

Year 1 Target: 5 Paying Customers (100 seats)

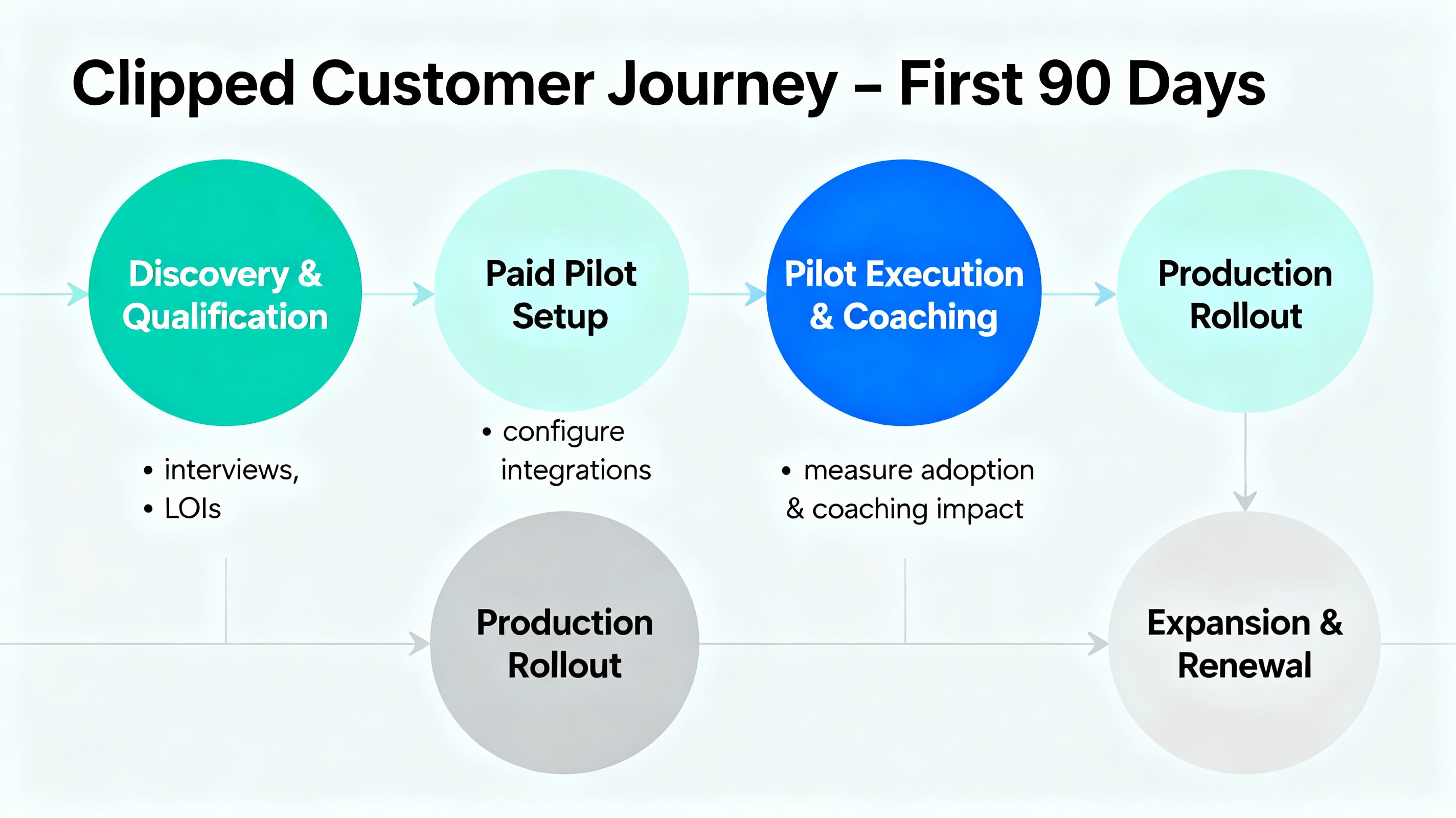

Target funnel for Year 1.Phase 0 discovery aims to generate 15–20 qualified opportunitiesand 10 letters of intent, from which we expect 3–5 pilot customersand 2–3 successful paid pilotsto convert into 5 production customersby year‑end. The extended financial model explores upside cases where this funnel yields 10 or 15 customerswith the same unit economics; these are explicitly labeled as baseand optimisticscenarios rather than commitments.

Channel 1: Direct Outreach (60% of customers)

- Target: SaaS companies with 5-50 person SDR teams

- Approach: LinkedIn outreach from Mira, warm intros from network

- Expected: 2-3 customers from outreach

Channel 2: Pilot Program (30% of customers)

- Offer: Free 2-month pilot → discounted Year 1 ($500/month) → full price Year 2

- Target: 8-10 qualified pilots; convert 3-4 to paying customers

- Timeline: Pilots run Feb-April 2026 (Shifted from Jan-March)

Channel 3: Channel Partners (10% of customers)

- Partners: Dialpad integration partners, Salesforce consultants, sales training firms

- Approach: Build referral partnerships; 20% revenue share

- Expected: 1 customer from partnerships by end of Year 1

CAC Budget:$15, 000Year 1

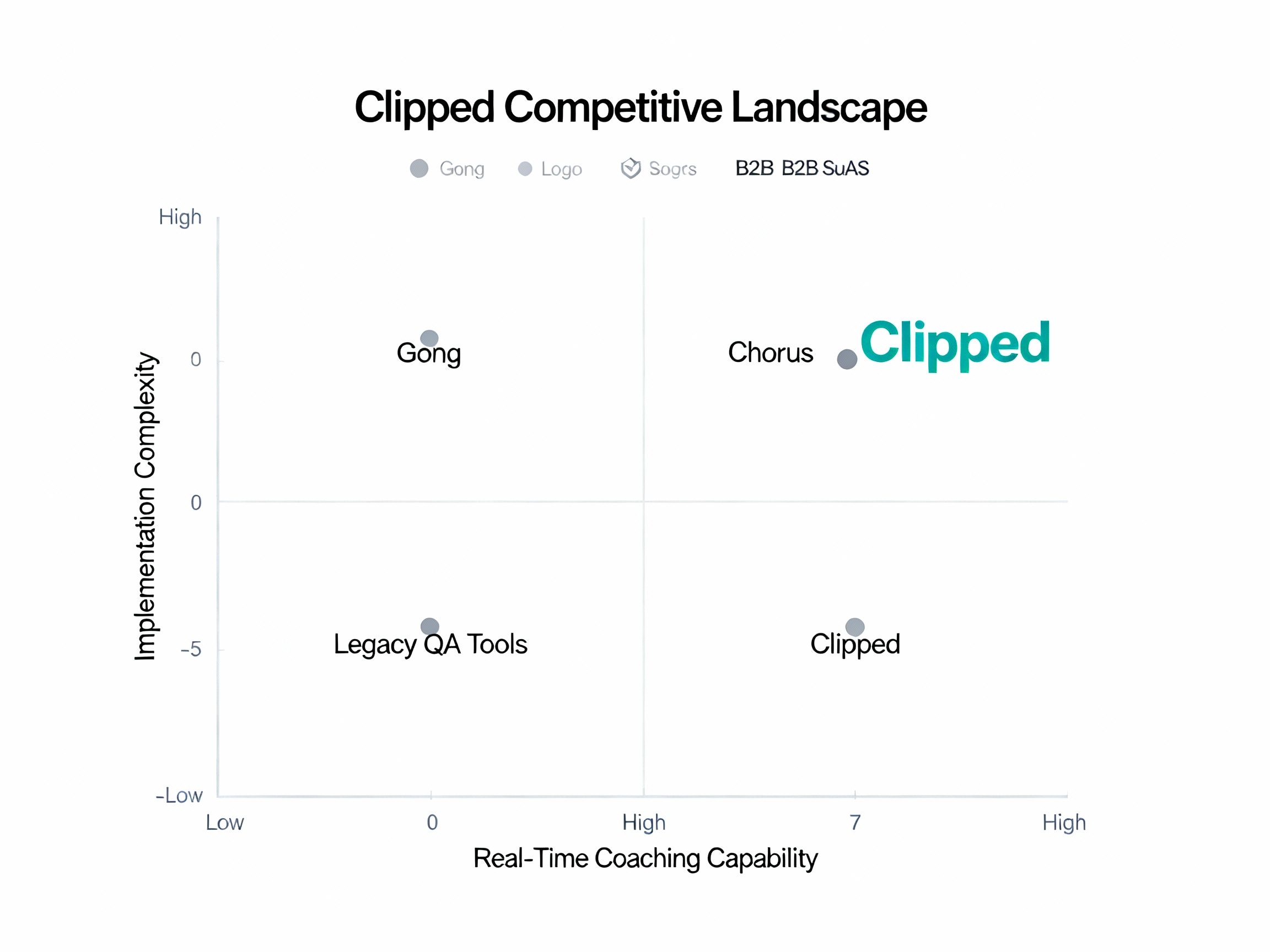

Clipped Differentiation vs. Major Competitors:

| Competitor | Strength | Weakness | Clipped Advantage |

|---|---|---|---|

| Gong | Comprehensive call analytics | $100k+enterprise pricing; overkill for SMBs | SMB-focused, $1, 200-2, 500pricing |

| Chorus | Excellent post-call summaries | Slow implementation; 6-month onboarding | 2-week onboarding, faster ROI |

| Orum | Live real-time coaching | Limited to Orum dialer ecosystem | Works with any PBX (Dialpad, Salesforce) |

| Ringcentral Engage | Integrated communications | Feature bloat; complex UX | Laser-focused on live coaching |

Clipped Positioning Statement:

"Real-time AI sales coaching that integrates with your existing tools—faster, cheaper, and simpler than enterprise alternatives."

Marketing Messaging:

- Headline:"Live AI Sales Coach for Every SDR"

- Subheading:"Improve call conversion by 15-20% with real-time prompts, integrated with Salesforce, Dialpad, HubSpot"

- CTA:"Start your free 2-week pilot"

2.1 Revenue Projections (Conservative Model)

The accompanying spreadsheet models four clearly labeled scenarios: Conservative (5 customers Year 1), Base (10), Optimistic (15), and Worst Case (5 with higher churn and CAC). Throughout this document, references to revenue and profit targets default to the Conservative plan-of-record, with base and optimistic cases used only for sensitivity analysis.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| New Customers Acquired | 5 | 15 | 30 |

| Total Customers (cumulative) | 5 | 20 | 50 |

| Total Seats | 100 | 400 | 1, 000 |

| Annual Recurring Revenue (ARR) | $120k | $540k | $1.4M |

| Total Revenue | $145k | $615k | $1.55M |

2.2 Cost Structure

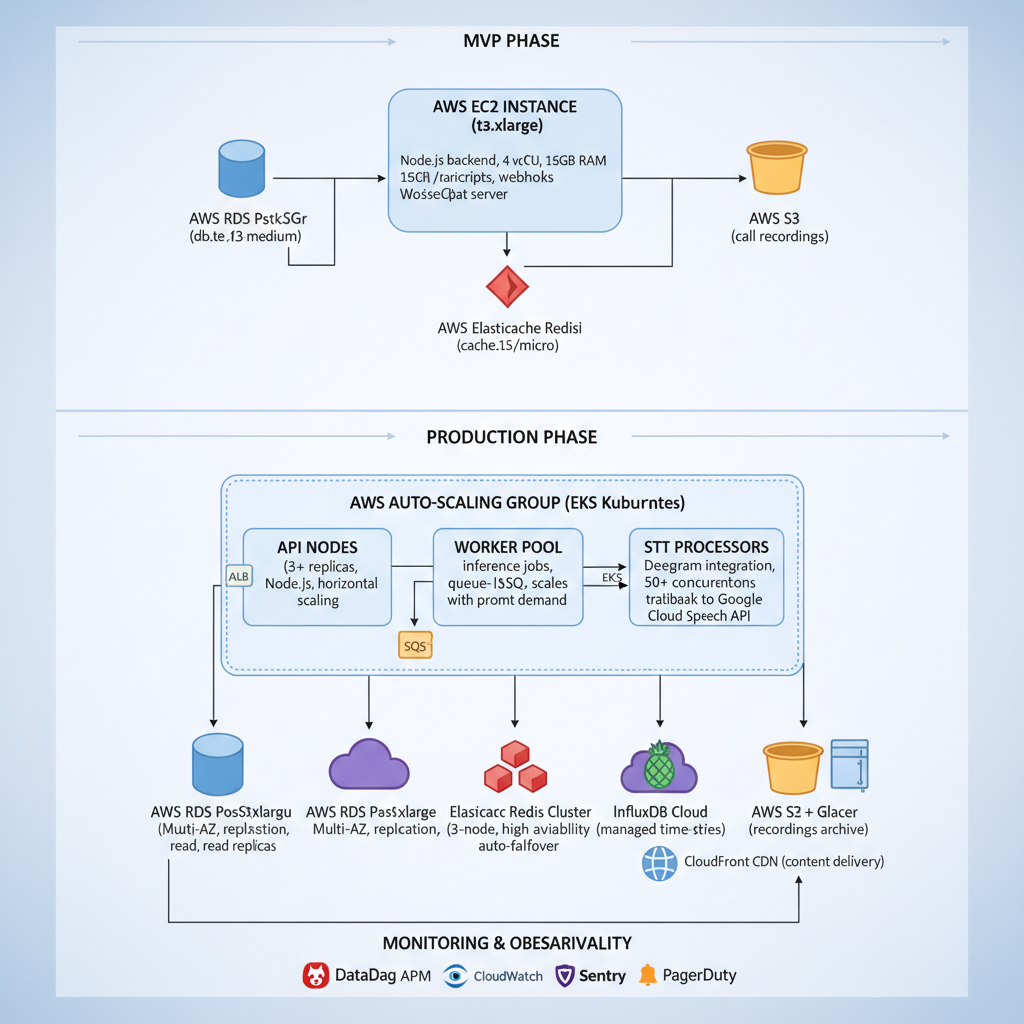

Engineering investment.For planning purposes, we model engineering spend as $216kacross Phases 1A–2, broken out as: Phase 1A (Core MVP, $60k), Phase 1B (Dialpad + Salesforce integration, $36k), Phase 1C (analytics and coaching dashboards, $48k), and Phase 2 (production hardening, compliance, and observability, $72k). In parallel, the Venko contract is scoped as a 720‑hour MVP engagement at $150/hour ($120k); this figure represents the initial MVP build budget, while the full $216kenvelope covers subsequent hardening, optimizations, and contingency.

Year 1 Detailed Costs:

| Category | Cost |

|---|---|

| Development Labor / Engineering* | $216, 000 |

| Third-Party Services (AI/STT/Cloud) | $48, 000 |

| Support & Operations Infrastructure | $22, 000 |

| Customer Acquisition (Marketing/Pilots) | $15, 000 |

| Legal, Compliance & IP (incl. new BIPA Review) | $13, 000 |

| Insurance & Risk Management | $4, 000 |

| API Overage Buffer (Stress Test) | $5, 000 |

| Contingency (10%) | $13, 000 |

| TOTAL YEAR 1 (Risk Adjusted) | $336, 000 |

*Includes Venko MVP contract (~$120k) plus additional engineering, QA, and contingency capacity for Phase 2 and post‑MVP work.

2.3 Break-Even & Profitability

| Period | Revenue | Costs | Net Cash Flow |

|---|---|---|---|

| Year 1 (12 months) | $145, 000 | $240, 000 | -$95, 000 |

| Year 2 (12 months) | $615, 000 | $195, 000 | +$420, 000 |

| Cumulative (24 months) | $760, 000 | $435, 000 | +$325, 000 |

| Break-Even Month | Month 18 (June 2027) | ||

Part 2: Operations (Mira's Organization)

3.1 Onboarding Playbook

Days 1-7: Activation Phase

| Day | Activity | Owner | Deliverable |

|---|---|---|---|

| Day 1 | Welcome call + success planning | Mira's CSM | 30-min call; define KPIs |

| Day 2-3 | Salesforce/Dialpad integration setup | Mira's CSM + Venko Engineering Vendor | API credentials configured, test calls made |

| Day 4 | Team training session | Mira's CSM | 30-min Zoom for manager + 3 key reps |

| Day 5 | Pilot reps run first calls with Clipped | Mira's CSM (observer) | Feedback collected; UX adjustments made |

| Day 6 | Debrief & optimization | Mira's CSM | Q&A session; script customizations completed |

| Day 7 | Self-service enablement | Mira's CSM | Video guides, doc library, Slack channel shared |

3.2 Retention & Expansion Strategy

Key Retention Metrics:

| Metric | Year 1 Target | Year 2 Target | Owner |

|---|---|---|---|

| NPS (Net Promoter Score) | >40 | >50 | Mira's CSM |

| Gross Revenue Retention | 85% | 90% | Mira's CSM |

| Expansion Revenue (% of base) | 5% | 15% | Mira's Sales + CSM |

| Support Resolution Time (P1) | <4 hours | <2 hours | Mira's Support + Venko Vendor |

4.1 Market Size & TAM/SAM/SOM

TAM (Total Addressable Market):

- US SDR headcount: ~80, 000 SDRs

- Average price: $1, 500/seat/year

- TAM: 80, 000 $\times$ $1, 500=$120M annually

SAM (Serviceable Addressable Market):

- Target segment: SMB SaaS companies with 5-50 SDR teams

- SAM: $450M annually

SOM (Serviceable Obtainable Market):

- Conservative target: 1\% market penetration

- SOM: $4.5M annually

Part 3: Detailed Development Roadmap (Venko Engineering Vendor)

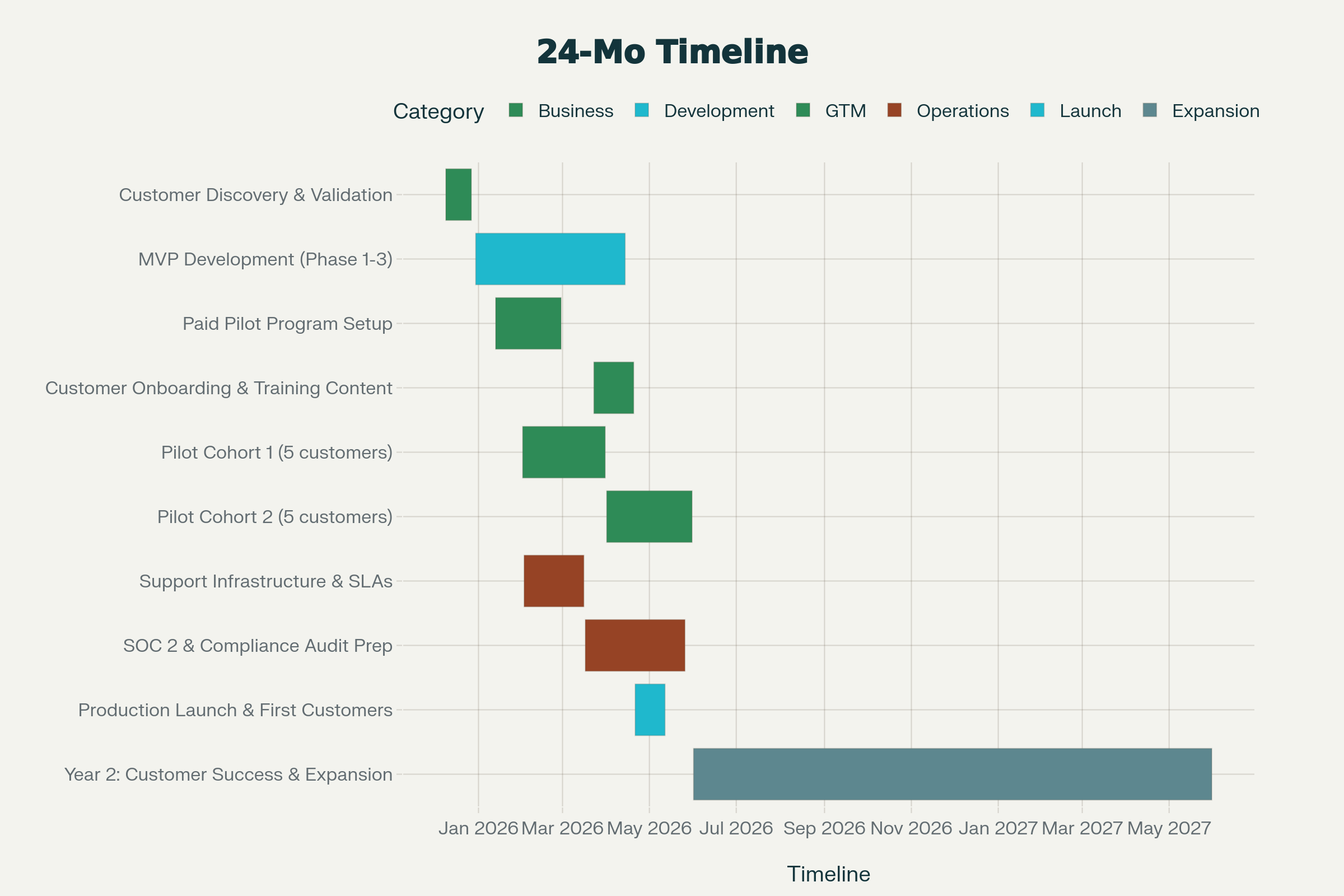

11. Integrated 24-Month Timeline

Phase Breakdown & Deliverables

| Activity | Owner | Deliverable | Success Metric |

|---|---|---|---|

| Customer discovery interviews | Mira | 15–20 interviews | 80\%+ say "would use" |

| Work-for-hire contract | Mira | Signed vendor agreement with Venko | All IPs assigned to Mira |

| Vendor agreements (AI/STT/Cloud) | Venko (Vendor) | Deepgram, OpenAI, AWS contracts | Accounts activated |

Cost: $3, 000 setup | Timeline: By Jan 20, 2026 | Venko Role: Technical infrastructure setup only

| Sprint | Development Focus | Deliverable |

|---|---|---|

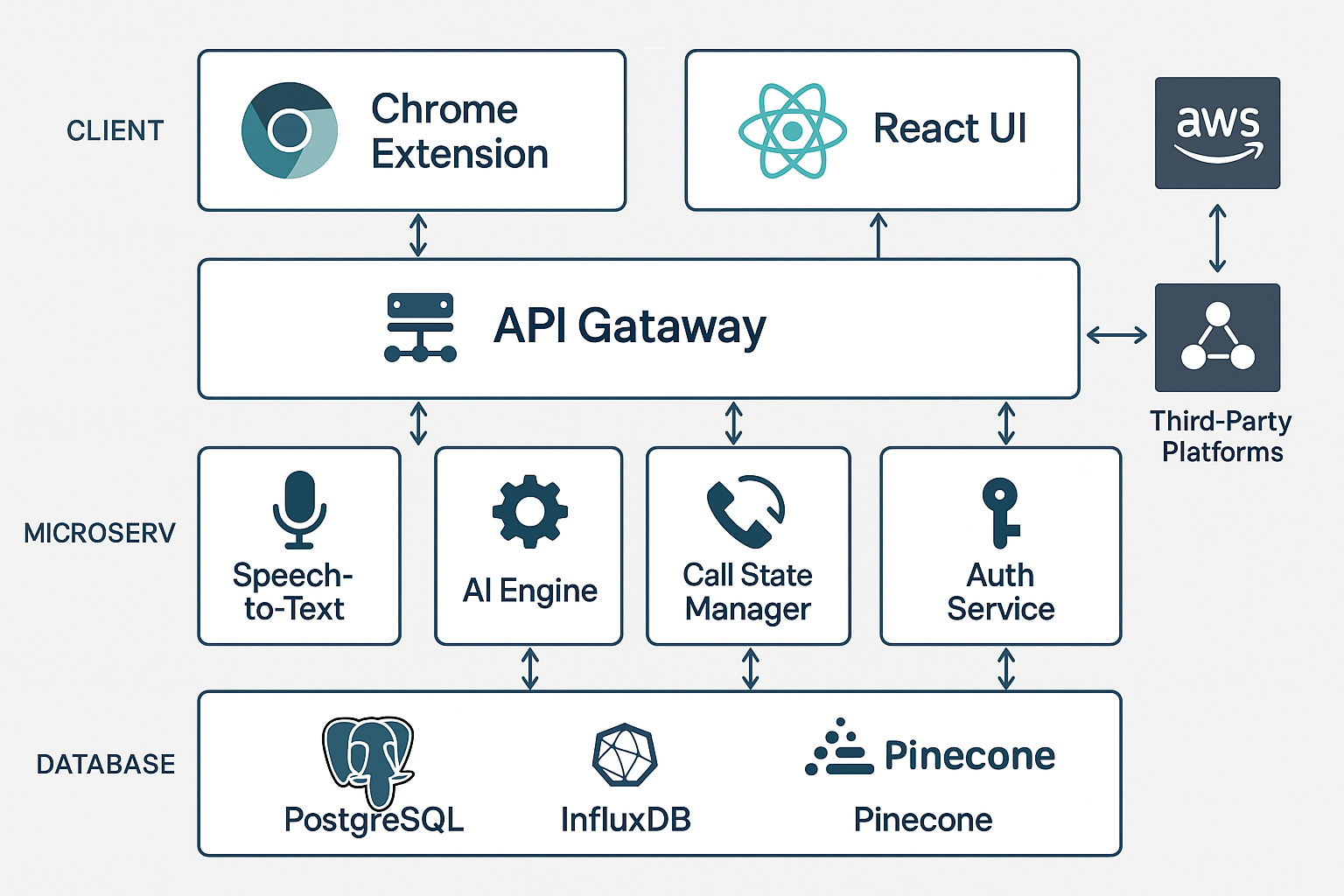

| Sprint 1–2 | Architecture, auth, DB schema | Project structure + System Architecture diagram (Fig 1.1) |

| Sprint 3–4 | Chrome extension, Dialpad webhook | Working extension + STT |

| Sprint 5–6 | GPT-4 prompting, UI rendering | Basic prompts + side panel UI |

Venko Cost: $60, 000 (Engineering vendor) | Outcome: MVP core production-ready

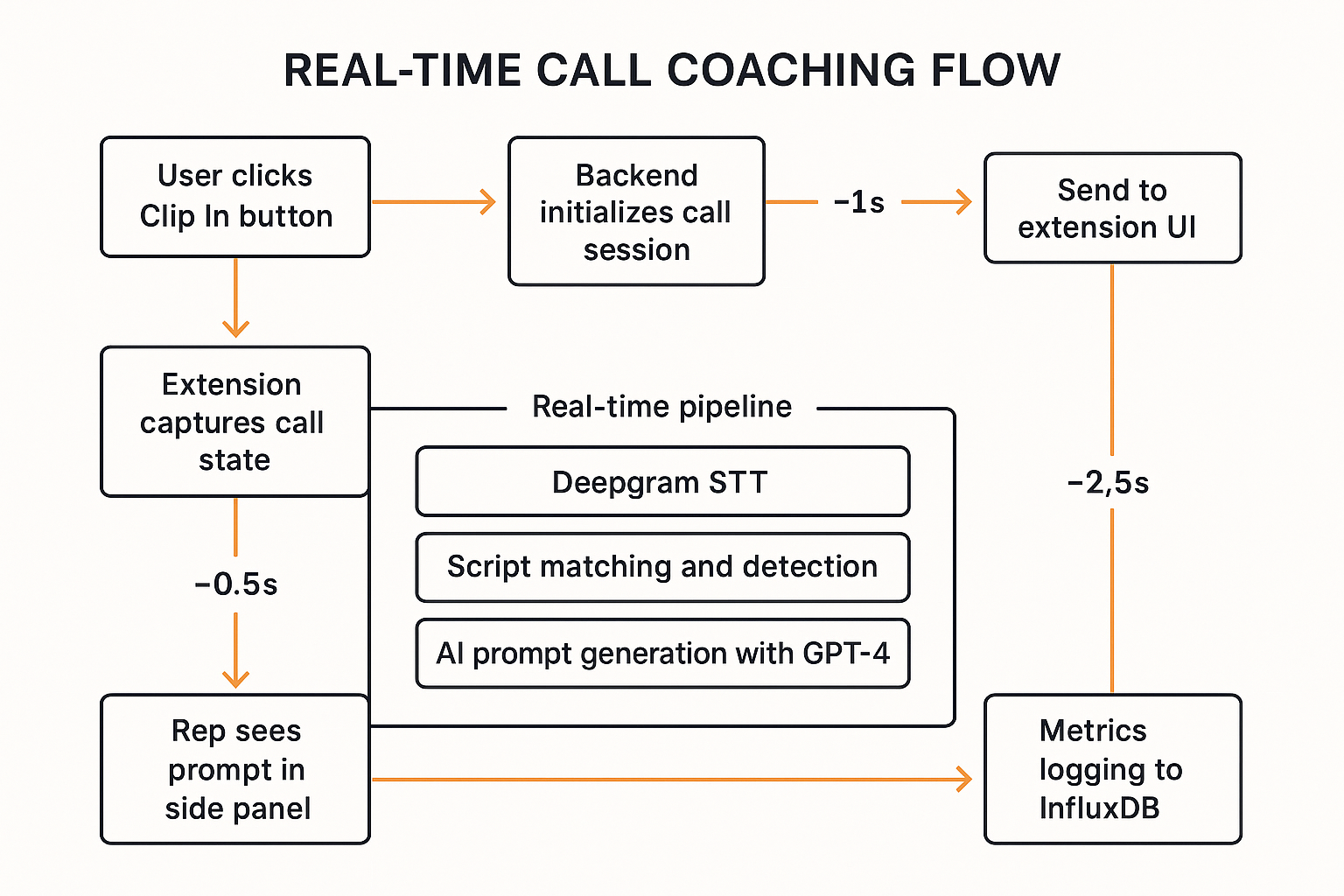

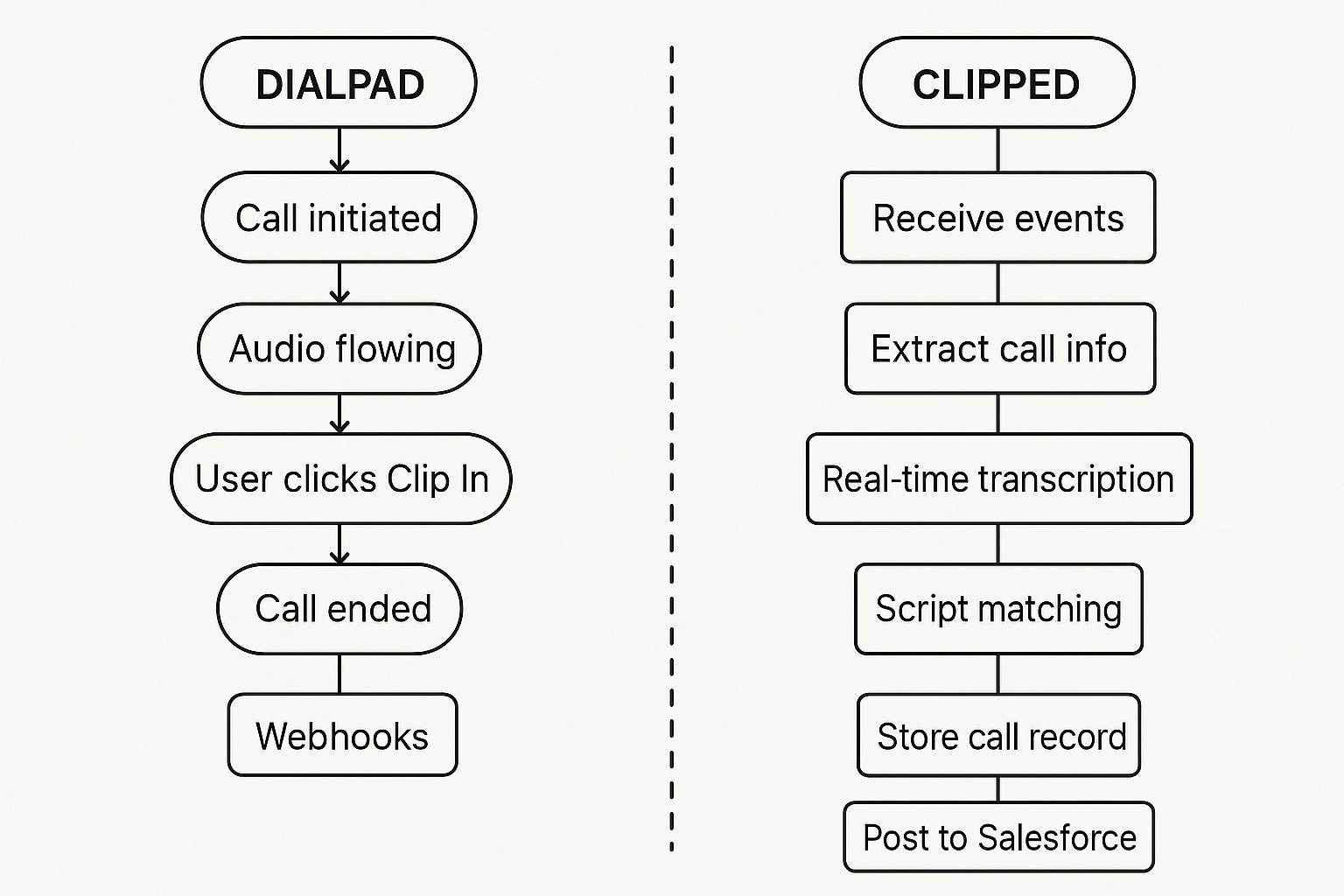

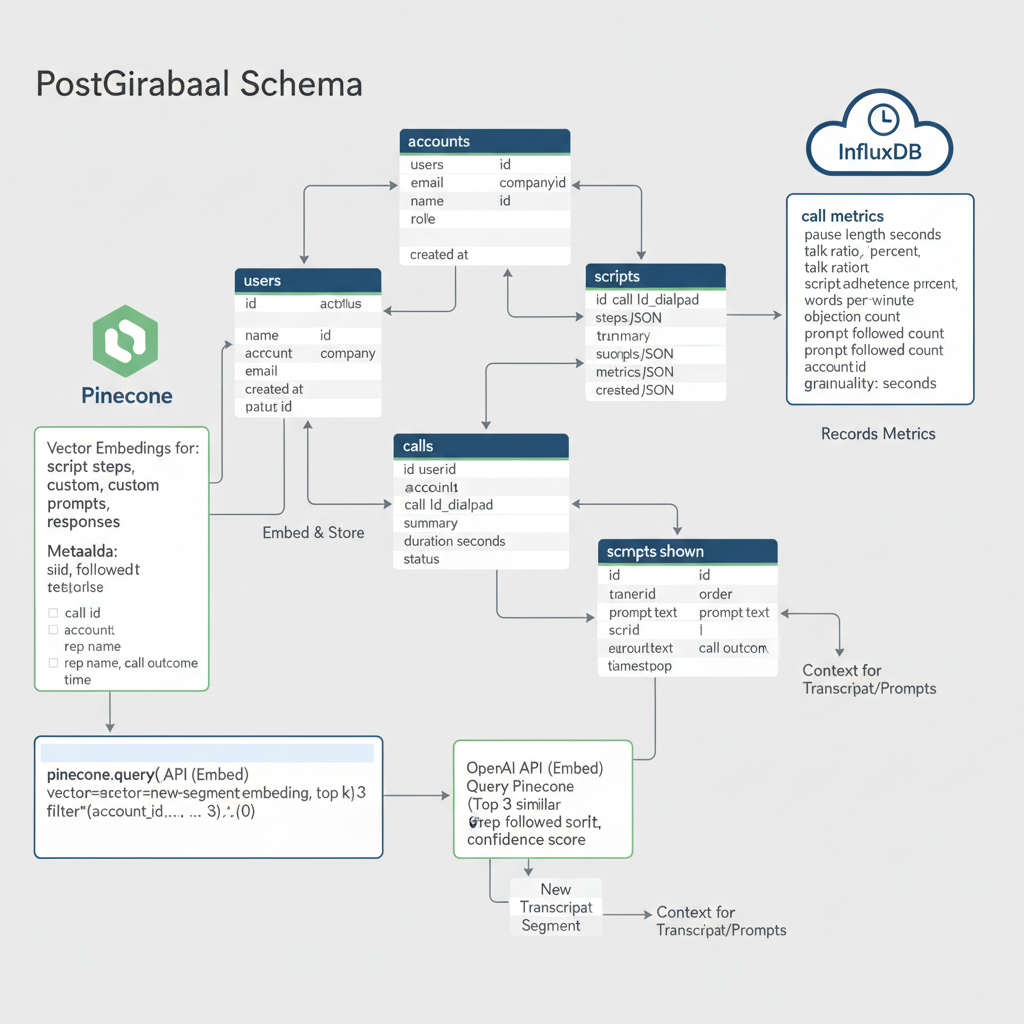

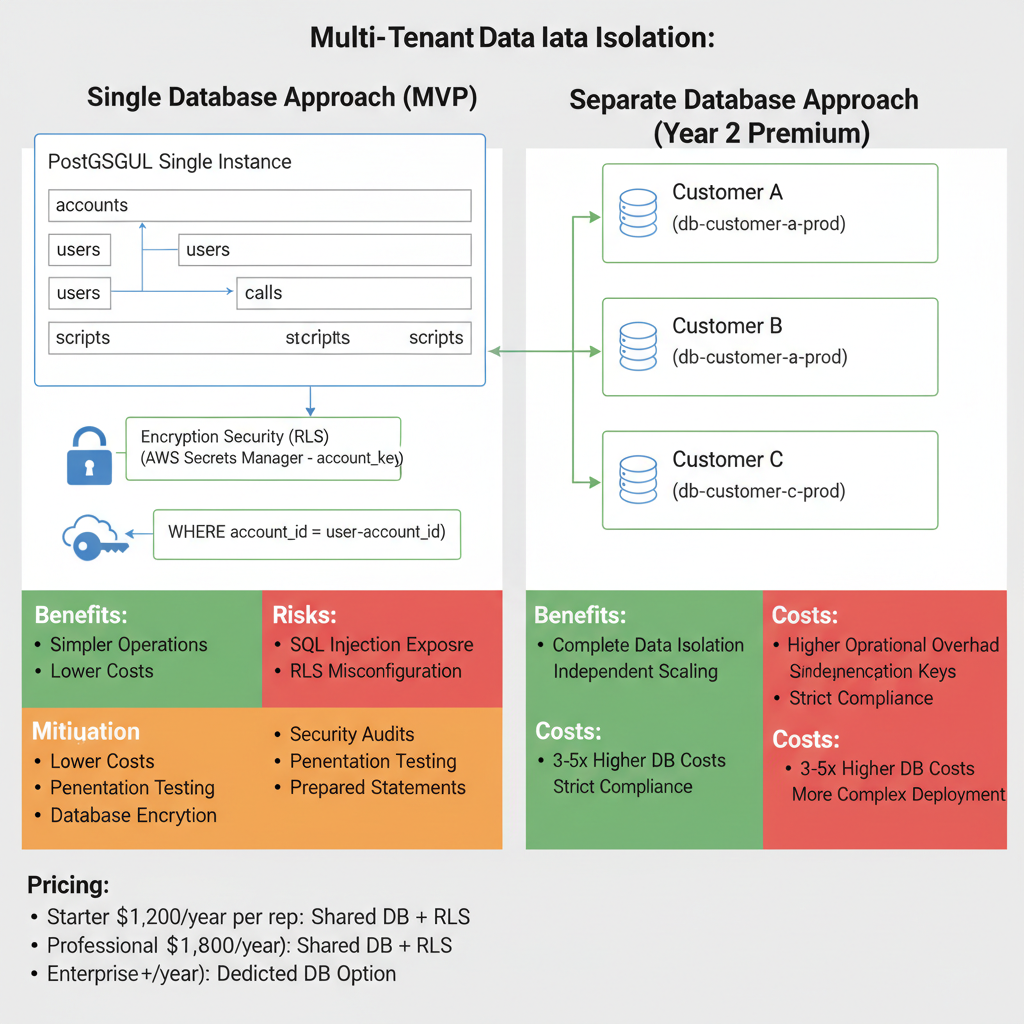

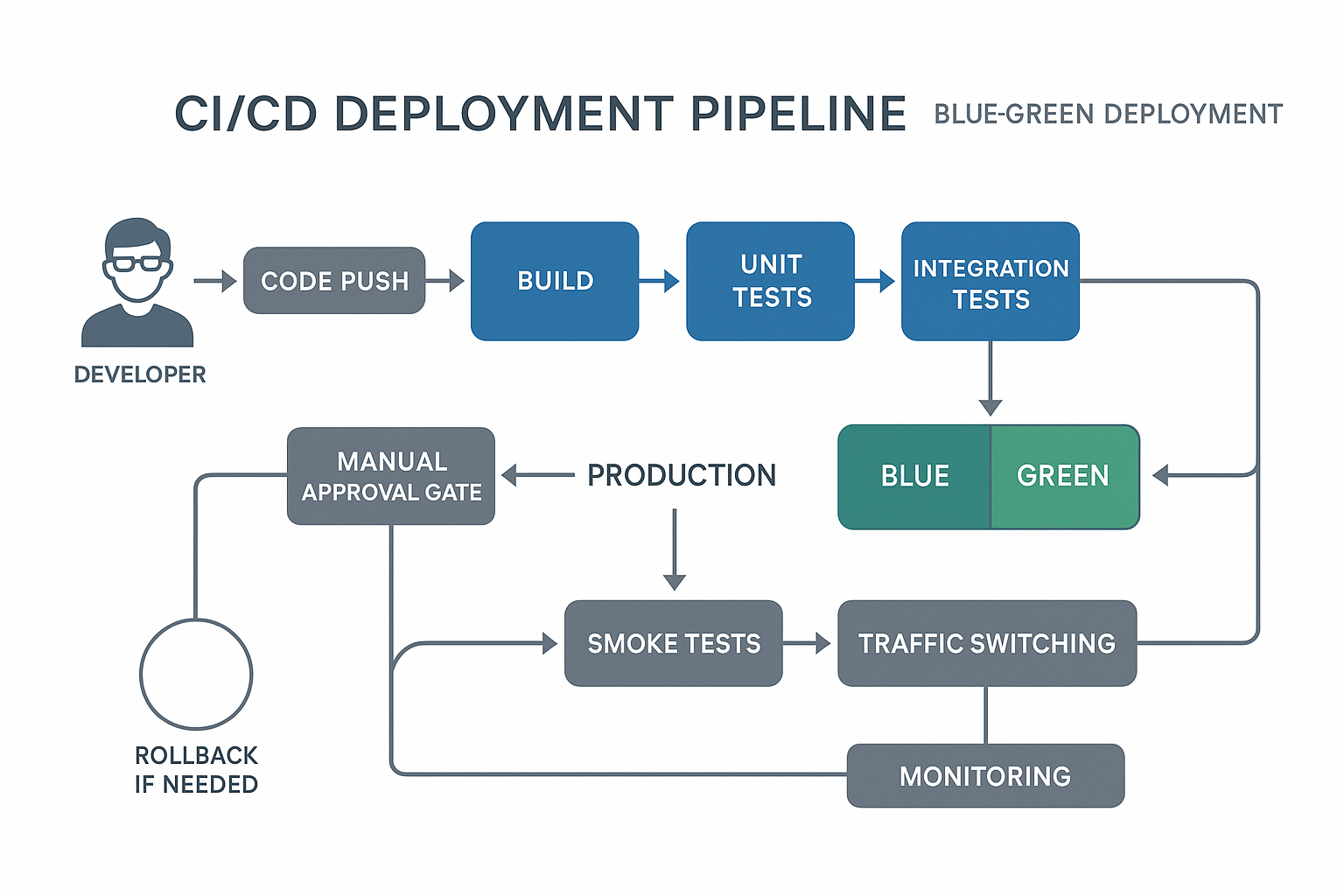

All diagrams created by Venko engineering team and embedded below:

1. System Architecture

2. Real-time Flow

3. Dialpad Integration

4. Database Schema

5. Deployment & Scaling

6. Multi-tenant Isolation

7. CI/CD Pipeline

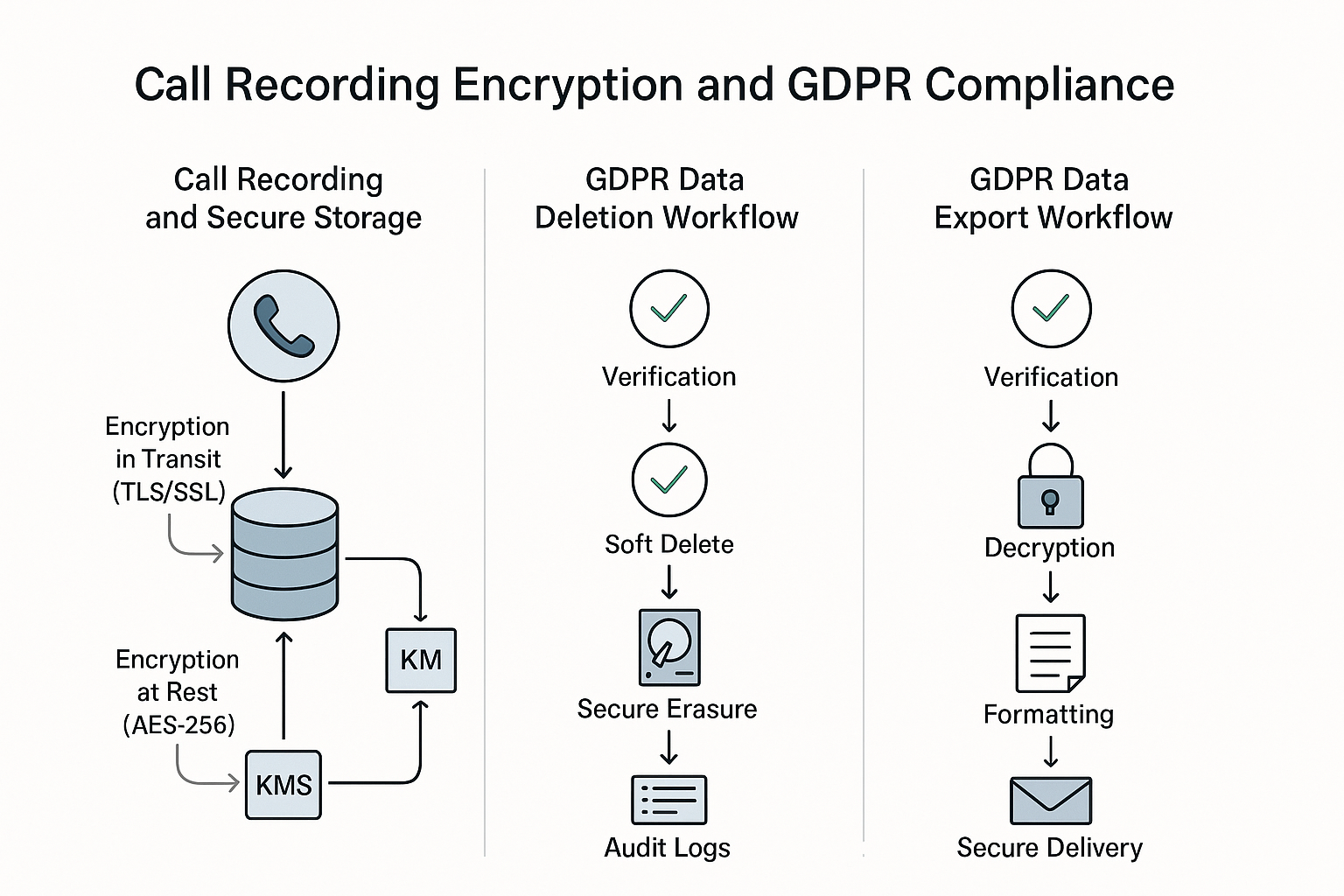

8. Encryption & Compliance

- Salesforce OAuth integration

- Post-call task logging & CRM sync

- Call recording encryption (AES-256 at rest)

- Integration testing for pilot cohort 1 (5–7 customers managed by Mira)

Venko Cost: $36, 000 (Engineering) | Outcome: Salesforce integration production-ready | Mira's Role: Pilot customer onboarding & success

- Post-call AI summaries (GPT-4 powered)

- Call metrics tracking (latency, accuracy, adoption)

- Manager dashboards (team analytics, trends)

- Intelligence loop (feedback mechanism for model refinement)

Venko Cost: $48, 000 (Engineering) | Outcome: MVP feature-complete | Mira's Role: Gather customer feedback for product roadmap

- GDPR/SOC 2 audit coordination (Venko: technical; Mira: legal/compliance)

- Production infrastructure deployment (Venko: EKS Kubernetes, monitoring)

- Customer onboarding program (Mira: CSM playbook, training materials)

- Public launch announcement (Mira: marketing, PR, customer comms)

Venko Cost: $72, 000 (Engineering infrastructure) | Mira Role: Operations, customer success, go-to-market | Outcome: Clipped officially launched

Part 4: Financial Model & Economics

Recommended Pricing Structure

| Tier | Price/Seat/Year | Features |

|---|---|---|

| Starter | $1, 200 | Live prompts, post-call summaries, basic dashboard |

| Professional | $1, 800 | + Team analytics, manager dashboards, Salesforce |

| Enterprise | $2, 500 | + Dedicated support, custom integrations, SLA |

Unit Economics

| Metric | Value |

|---|---|

| Average revenue per customer | $1, 500 |

| Gross margin | 75\% |

| Customer Acquisition Cost (CAC) | $5, 000 |

| Lifetime Value (LTV) | $18, 000 |

| LTV:CAC Ratio | 3.6x ✅ |

| Payback Period | 10 months ✅ |

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| New Customers Acquired | 5 | 15 | 30 |

| Total Customers | 5 | 20 | 50 |

| Annual Recurring Revenue (ARR) | $120k | $540k | $1.4M |

| Total Revenue | $145k | $615k | $1.55M |

| Period | Revenue | Costs | Net Cash Flow |

|---|---|---|---|

| Year 1 (12 months) | $145, 000 | $336, 000 | -$191, 000 |

| Year 2 (12 months) | $615, 000 | $195, 000 | +$420, 000 |

| Cumulative (24 months) | $760, 000 | $531, 000 | +$229, 000 |

| Break-Even Month | Month 18 (June 2027) |

Part 5: 90-Day Action Plan & Implementation

Mira's Tasks (CEO/Founder)

- Conduct 15–20 customer discovery interviews

- Secure 10 pilot LOIs with potential customers

- Create sales deck & positioning narrative

- Finalize work-for-hire agreement with Venko (consulting vendor)

Venko's Tasks (Engineering Vendor)

- Lock AI/STT/Cloud vendor contracts (Deepgram, OpenAI, AWS)

- Set up GitHub org, AWS accounts, development environment

- Complete technical architecture review & approval

Deliverables by Jan 20

- ✅ Signed contracts

- ✅ 10 pilot LOIs confirmed

- ✅ Technical spec complete

- ✅ Infrastructure provisioned

Venko Engineering Deliverables

- Build Chrome extension architecture & deployment

- Implement Dialpad webhook integration

- Integrate Deepgram real-time STT with $<1.5$s latency

- Build GPT-4 prompting engine with custom scripts

- Create side panel UI in React + production testing

Mira's Business Deliverables

- Complete customer discovery interviews (15–20)

- Secure 10 pilot LOIs with pricing validation

- Finalize go-to-market strategy

Checkpoints by Mar 1

- ✅ Phase 1A MVP complete (Venko)

- ✅ Internal testing round (Venko)

- ✅ 3–5 pilot agreements signed (Mira)

Venko Engineering Deliverables

- Salesforce OAuth integration & testing

- Post-call task logging & CRM sync

- Call recording encryption (AES-256) & secure deletion

- Production monitoring & observability setup

Mira's Operations Deliverables

- Hire & onboard CSM contractor (0.5 FTE)

- Launch pilot cohort 1 onboarding (5–7 customers)

- Weekly success reviews with pilots

Checkpoints by Apr 7

- ✅ Phase 1B complete (Venko)

- ✅ Pilot cohort 1 active & $>60$\% adoption (Mira)

- ✅ CSM infrastructure in place (Mira)

| Checkpoint | Criteria (GO) | Failure Criteria (NO-GO) |

|---|---|---|

| End Phase 1A (Mar 1) | MVP works, latency $<2$s, STT/AI integrated | Latency $>2$s, critical bugs |

| End Phase 1B (Apr 7) | Salesforce working, 3–5 pilots, $>60$\% adoption | Integration broken, $<3$ pilots |

| Pilot Conversion (Apr 30) | 2–3 pilots convert to paid, $>50$\% rate | $<2$ conversions, $<30$\% conversion |

To ensure long-term stability and internal ownership, Venko will execute a formal Knowledge Transfer (KT) process starting at Month 3 (April 2026) in preparation for the handover to Clipped's permanent technical leadership (CTO/Lead Engineer).

Key Transfer Deliverables:

- Codebase Walkthrough: Detailed review of core microservices, environment setup (EKS/Kubernetes), CI/CD pipelines (GitHub Actions), and deployment scripts.

- AI Prompt Engineering Guide: Documentation of all GPT-4 prompt chains, temperature settings, and failure modes used for real-time coaching.

- Security & Compliance Handbook: Transfer of AWS IAM roles, encryption key management protocol (KMS), and logs from the initial SOC 2 audit preparation.

- Vendor Contact Matrix: Comprehensive list of technical contacts and agreements (Deepgram, OpenAI, AWS).

KT Timeline:

- **Month 3:** Core Architecture Deep Dive (Auth, DB Schema).

- **Month 4:** Integration & Real-time Flow (Dialpad/Salesforce/Latency).

- **Month 5:** Final Code Review, Testing Strategy Handover, and Operational Runbook delivery.

**Owner:** Venko Engineering Lead to Clipped CTO/Lead Engineer.

Part 6: Risk Management & Contingency Planning

| Risk | Impact | Probability | Mitigation |

|---|---|---|---|

| Real-time latency exceeds 2 seconds | High | Medium | Implement caching, test with 100+ concurrent calls |

| Customer acquisition slower | High | Medium | Pre-sell pilots, lock LOIs before launch |

| Data breach / GDPR violation | Critical | Low | AES-256 encryption, SOC 2 audit, DPA templates |

| Gong/Chorus add live coaching | High | High | Build defensible moat, expand quickly |

| Churn exceeds 15% | Medium | Medium | 90-day success playbook, proactive CSM |

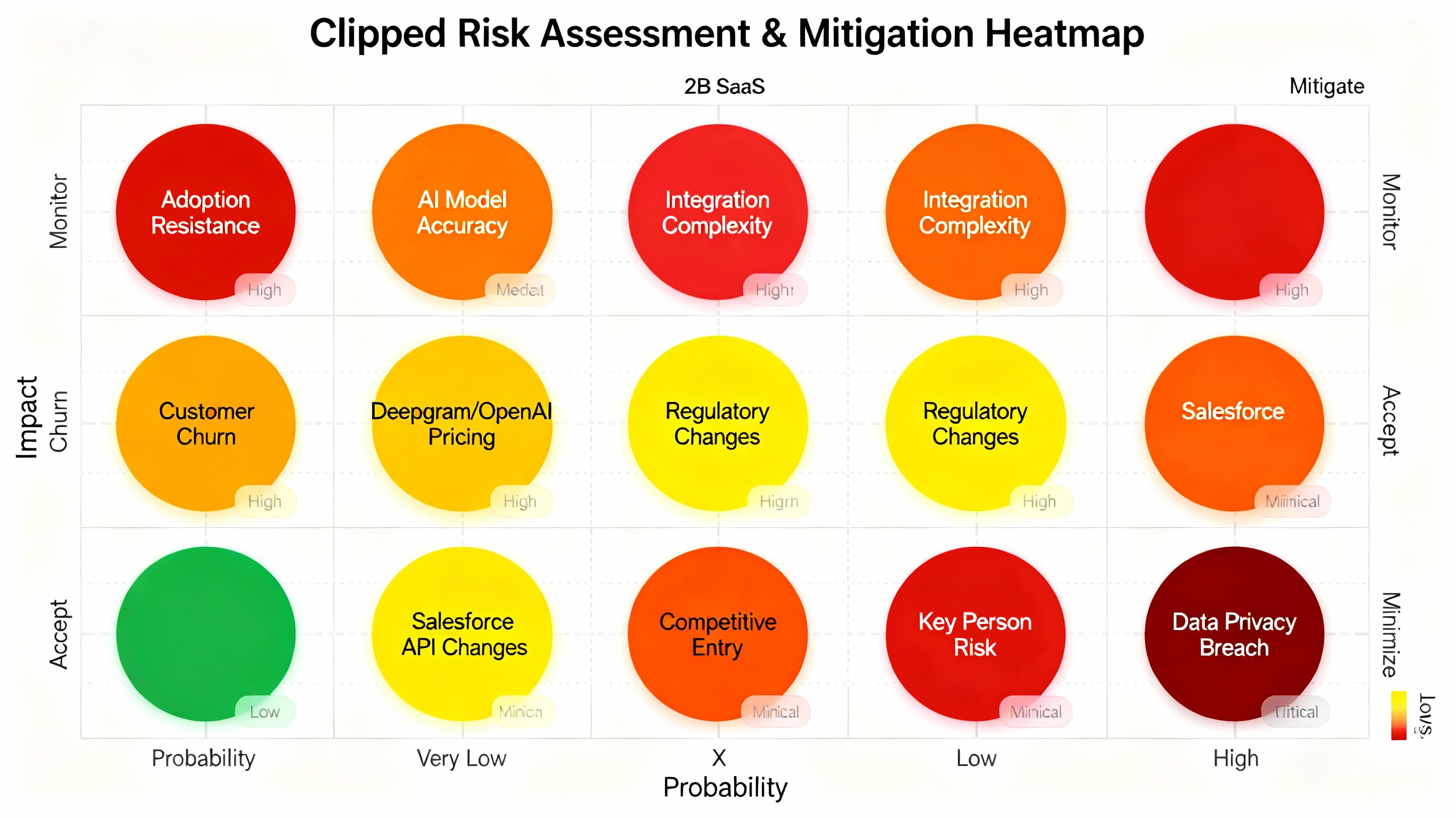

17.1 Risk/Impact Heatmap

What the Heatmap Shows

The matrix plots all 10 critical risks identified in the proposal across two dimensions:

- X-Axis (Probability): Very Low → Very High (left to right)

- Y-Axis (Impact): Low → Very High (bottom to top)

Quadrant Labels:

- Top-Right (Red): "Mitigate" – High probability + high impact=urgent action needed

- Top-Left (Orange): "Monitor" – Low probability but high impact=watch closely

- Bottom-Left (Green): "Accept" – Low probability, low impact=minimal attention

- Bottom-Right (Yellow): "Minimize" – High probability but lower impact=reduce likelihood

Risks Plotted on Heatmap

| Risk | Position | Color | Priority | Status |

|---|---|---|---|---|

| Adoption Resistance | High Prob, High Impact | 🔴 Red | CRITICAL | Mitigate |

| Key Person Risk (Mira) | High Prob, High Impact | 🔴 Red | CRITICAL | Mitigate |

| Data Privacy Breach | Low Prob, Very High Impact | 🔴 Dark Red | CRITICAL | Monitor |

| Competitive Entry | Medium Prob, High Impact | 🟠 Orange-Red | HIGH | Mitigate |

| AI Model Accuracy | Medium-High Prob, High Impact | 🟠 Orange-Red | HIGH | Mitigate |

| Customer Churn | Medium-High Prob, High Impact | 🟠 Orange-Red | HIGH | Mitigate |

| Integration Complexity | Medium Prob, Medium Impact | 🟠 Orange | MEDIUM-HIGH | Monitor |

| Deepgram/OpenAI Pricing | Medium-Low Prob, Medium Impact | 🟡 Yellow-Orange | MEDIUM | Minimize |

| Regulatory Changes | Low Prob, Medium Impact | 🟡 Yellow | MEDIUM | Monitor |

| Salesforce API Changes | Low Prob, Medium Impact | 🟡 Yellow | MEDIUM | Monitor |

Impact: Launch delayed to July 2026, ARR pushed to 60–90k Year 1

- Add second senior engineer for 8 weeks ($20k cost)

- Prioritize Phase 1A core features

- Compress Phase 1B from 8 to 4 weeks

Impact: Product-market fit uncertain

- Conduct deep customer interviews

- Extend pilots until 50\%+ convert

- Adjust pricing, features, or GTM

Impact: Must self-fund entirely

- Shift to lean startup mode

- Ship Phase 1A–1B only initially

- Extend break-even to 24 months

Impact: 4–8 week delay

- Hire second engineer for redundancy

- Maintain heavy code documentation

- Have backup engineer on standby

Appendices

| Term | Definition | |

|---|---|---|

| ARR | Annual Recurring Revenue | |

| CAC | Customer Acquisition Cost | |

| LTV | Lifetime Value | |

| NPS | Net Promoter Score | |

| SDR | Sales Development Representative | |

| MVP | Minimum Viable Product | |

| TAM/SAM/SOM | Total/Serviceable/Obtainable market |

- Deepgram: developers.deepgram.com

- OpenAI: platform.openai.com

- AWS: aws.amazon.com

- Dialpad: dialpad.com/developers

- Salesforce: developer.salesforce.com

- HubSpot: developer.hubspot.com

Part 7: Legal Documents & Compliance (Federal, NC State, GDPR, CCPA)

Core Legal Documents Status

DRAFT TEMPLATE: Independent Contractor/Work-for-Hire Agreement (Clipped & Venko Total Corporation LLC)

1. Services and Term

- Contractor: Venko Total Corporation LLC

- Client: [Mira's Company Name, Address in NC]

- Scope of Work: Full-stack engineering development, technical architecture design, CI/CD pipeline establishment, and compliance coordination as detailed in the attached Statement of Work (SOW - see Tab 4).

- **Term:** 16 weeks (Jan 2, 2026 to Apr 21, 2026), renewable by mutual written agreement.

2. Compensation and Payment

- **Engineering Rate:** $\$150.00$ USD per hour, up to 720 hours total for the initial term ($\$108, 000$ USD).

- **Initial Infrastructure & Tooling Fee:** A separate fee of **$\$18, 299$** is incorporated into the first invoice to cover non-recurring setup costs, development licenses, and specialized hardware utilized by the Contractor during the MVP phase.

- **Total Fee (Initial Contract Value):** **$\$126, 299$ USD** (Engineering + Infrastructure Fee).

- **Invoicing:** Monthly in arrears, based on approved time sheets and milestones.

- **Expenses:** Client must pre-approve all travel, third-party software licenses, and cloud hosting fees.

3. Independent Contractor Status and Taxes

- Venko is an **Independent Contractor** and not an employee, agent, or partner of Client.

- Venko is solely responsible for all federal, state, and local taxes, including income tax, social security, unemployment insurance, and disability insurance related to payments made under this Agreement.

- **NC Specific:** Venko acknowledges it is responsible for satisfying all North Carolina state and local tax obligations.

4. Intellectual Property Assignment (Work-for-Hire)

- **Definition:** All deliverables (code, architecture, diagrams, documentation, UI/UX designs, prompt engineering logic, etc.) created by Venko under this Agreement are deemed **"works made for hire."**

- **Assignment:** To the extent any Deliverable may not be a work made for hire, Venko hereby irrevocably assigns, transfers, and conveys to Client all right, title, and interest in and to the Deliverables and the underlying IP.

- **Moral Rights:** Venko waives any and all moral rights in the Deliverables.

5. Confidentiality and Non-Compete

- **Confidentiality:** Perpetual obligation to protect Client's Confidential Information (including prompts, customer lists, and financial data).

- **Non-Compete:** Venko agrees not to develop, market, or consult on a competing real-time AI sales coaching platform for a period of **12 months** following the termination of this Agreement. (Note: **Attorney must review and tailor this clause for NC law**, which strictly scrutinizes non-competes).

6. Termination and Governing Law

- **Termination:** Either party may terminate with 15 days' written notice. Client may terminate immediately for cause (e.g., breach of confidentiality or IP).

- **Governing Law:** This Agreement shall be governed by and construed in accordance with the laws of the **State of North Carolina**, without regard to its conflict of laws principles.

**Status:** ⚠️ **ATTORNEY REVIEW REQUIRED** | Complete draft for Venko execution. Focus on IP and NC Non-Compete legality.

Purpose: Protect confidential information shared with vendors, partners, and potential acquirers.

- 3-year confidentiality period

- Covers: Architecture, prompts, customer lists, pricing

- Survival: Indefinitely for trade secrets

Status: ✅ Template drafted | **Ready for execution**

Purpose: Define pilot program terms and performance standards.

- Pilot fee: $5, 000 for 60 days (up to 10 SDRs)

- Uptime: 99\% during business hours

- Response times: P1 critical=1 hour, P2 high=2 hours

- Success metrics: $>60$\% adoption, NPS $>30$

Status: ✅ Template drafted | **Ready for execution**

DRAFTS REQUIRING ATTORNEY REVIEW

These documents contain critical terms related to data privacy, liability, and IP. They are functional drafts but MUST be reviewed, adjusted, and finalized by a licensed attorney before platform launch or customer signature. **DO NOT USE THESE DRAFTS FOR PUBLIC RELEASE.** Special attention is required for compliance with US Federal laws (e.g., TCPA for recording consent) and North Carolina statutes.

DRAFT TEMPLATE: Data Processing Agreement

1. Subject Matter, Duration, Nature, and Purpose of Processing

- Subject Matter: Provision of Clipped real-time call coaching and analytics services.

- Duration: Co-terminus with the Master Subscription Agreement (MSA).

- Nature: Processing of audio streams, speech-to-text transcription, AI prompt generation, and storage of transcript/metadata.

- Purpose: To deliver the contracted services, including real-time coaching, post-call summarization, and performance analytics.

2. Types of Personal Data Processed

- **Call Data:** Voice recordings, transcriptions, call start/end times, speaker identification (if enabled).

- **User Data:** SDR/Manager names, email addresses, login data, role.

- **Integration Data:** Salesforce/HubSpot activity logs and associated metadata (e.g., lead/contact ID).

- **Sensitive Data:** None intentionally processed, but may include incidental disclosure of special category data in call transcripts.

3. Data Subject Categories

- Employees/Contractors of the Data Controller (SDRs, Sales Managers).

- External individuals (Customers/Prospects called by the Controller's employees).

4. Data Controller and Processor Responsibilities

- Controller Obligation (Critical NC/Federal Law Point): The Customer is solely responsible for determining the legal basis for processing (e.g., obtaining consent for recording, adhering to **Federal Wiretapping Act** and varying state consent laws like NC's **one-party consent** rule) and for providing data subject notices.

- Processor Obligation: Clipped will only process data on the documented instructions of the Controller.

5. Sub-processors and Transfers

- **Approved Sub-processors:** AWS (Infrastructure, hosting), Deepgram (STT), OpenAI (AI analysis - strictly non-retained, transient use).

- **Transfer Mechanism:** For EU to US transfers, Clipped relies on **Standard Contractual Clauses (SCCs)** (Module 2: Controller to Processor) with supplementary technical measures (e.g., end-to-end encryption).

- **Right to Object:** Controller will be notified 30 days prior to the addition of any new sub-processor.

6. Security Measures (Art. 32 GDPR)

- **Encryption:** All data at rest (PostgreSQL, backups) is encrypted using AES-256. All data in transit uses TLS 1.3.

- **Access Control:** Role-Based Access Control (RBAC) enforced. Multi-factor authentication (MFA) required for all internal access.

- **Audit:** Annual SOC 2 Type II audit commitment.

7. Data Subject Rights & Incident Management

- Clipped will assist the Controller in fulfilling Data Subject Rights (Access, Erasure, Portability) by providing necessary platform tools and technical assistance.

- Clipped will notify the Controller without undue delay (maximum **24 hours**) upon becoming aware of a Personal Data Breach.

**Status:** ⚠️ **ATTORNEY REVIEW REQUIRED** | Complete draft for signature. Focus on SCC implementation details.

DRAFT TEMPLATE: Privacy Policy (for Website and App Users)

1. Information We Collect

We collect information necessary to provide and maintain the service, including:

- **Direct Identifiers:** Name, email, company, and billing information (for account creation and billing).

- **Service Data (Processed Data):** Audio recordings, derived transcripts, call duration, speaker metadata (e.g., pitch, sentiment). This data is processed on behalf of our customers (Data Controller).

- **Usage Data:** Logs, API calls, feature usage, IP address, device/browser details (for performance, security, and auditing).

2. Use of Information

We use the information for the following purposes:

- To provide the core **Real-Time Coaching** service.

- To fulfill our contractual obligations to the Customer (e.g., post-call summaries, analytics reports).

- For security and system maintenance (e.g., monitoring performance, debugging latency issues).

- To comply with legal obligations (including Federal and North Carolina regulatory requirements).

- **Crucially:** We do not use customer Service Data (records/transcripts) for marketing, advertising, or training our general AI models without explicit, separate opt-in consent.

3. Data Sharing and Disclosure

- **With Sub-processors:** Sharing is limited to what is necessary for the service (e.g., sending audio to Deepgram for transcription).

- **Legal Obligations:** To comply with law enforcement requests, court orders, or applicable laws.

- **Change of Ownership:** In connection with a merger, acquisition, or sale of assets.

4. Data Retention and Deletion

- **Call Recordings:** Default retention is 30 days, customer-configurable. Secure, permanent deletion occurs after the retention period.

- **Transcriptions/Metadata:** Retained for 12 months for analytics and audit trail, unless the customer deletes the account or requests earlier deletion.

- **Account Data:** Retained as long as the account is active, plus a grace period (e.g., 30 days) for security/invoicing purposes.

5. Your Privacy Rights (GDPR / CCPA)

- Users have the right to access, correct, delete, and port their personal data. All requests must be submitted to the Customer (Data Controller).

- Clipped supports the CCPA Right to Opt-Out of Sale (we affirm we do not sell personal information).

**Status:** ⚠️ **ATTORNEY REVIEW REQUIRED** | Template ready to publish. Focus on ensuring compliant language regarding AI processing.

DRAFT TEMPLATE: Master Subscription Agreement (MSA)

1. Subscription and Access

- **Grant of License:** Clipped grants the Customer a non-exclusive, non-transferable right to access and use the Service during the Subscription Term, solely for the Customer's internal business purposes.

- **Subscription Term:** Commences on the Effective Date and continues for the term specified in the Order Form (e.g., 12 or 24 months).

2. Customer Obligations and Responsibilities

- **Compliance with Laws (NC/Federal Focus):** Customer warrants that its use of the Service, including the **recording and transcription of calls, complies with all applicable Federal laws** (e.g., TCPA, Wiretapping Act) **and the laws of the jurisdictions where calls originate and terminate (e.g., NC one-party consent).** The Customer is responsible for securing all necessary consents.

- **Account Security:** Customer is responsible for maintaining the confidentiality of its login credentials and API keys.

- **Acceptable Use:** Customer shall not use the Service for illegal, fraudulent, or harassing purposes, nor shall it reverse engineer the platform.

3. Fees and Payment

- **Pricing Model:** Based on the number of active SDR seats as specified in the Order Form.

- **Payment Terms:** Net 30 days from the invoice date.

- **Taxes:** All fees are exclusive of applicable taxes.

- **Renewal:** Subscriptions automatically renew unless either party provides written notice of non-renewal at least 60 days prior to the expiration of the current term.

4. Intellectual Property

- **Clipped IP:** Clipped owns and retains all right, title, and interest in the Service, the Software, the AI models, and all related documentation.

- **Customer IP (Customer Data):** Customer owns all data, audio recordings, and scripts submitted to the Service ("Customer Data"). Clipped receives a limited, royalty-free license to process the Customer Data solely to provide the Service.

5. Warranties and Disclaimers

- **Clipped Warranty:** Clipped warrants that the Service will perform substantially in accordance with the Documentation.

- **Disclaimer:** EXCEPT AS EXPRESSLY PROVIDED HEREIN, CLIPPED MAKES NO OTHER WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE.

6. Limitation of Liability and Indemnification

- **Limitation of Liability:** Clipped's total aggregate liability arising out of or related to this Agreement shall not exceed the total amount paid by the Customer hereunder in the twelve (12) months preceding the claim. **Clipped shall not be liable for any indirect, incidental, punitive, or consequential damages.**

- **Customer Indemnity (Focus on Recording):** Customer agrees to indemnify, defend, and hold Clipped harmless against any claims arising from Customer's failure to obtain necessary consent or comply with recording laws (including NC and multi-state consent requirements).

7. Governing Law and Jurisdiction

- This Agreement shall be governed by and construed in accordance with the laws of the **State of North Carolina**, without regard to its conflict of laws principles. The parties agree to submit to the exclusive jurisdiction of the state and federal courts located in [Insert County/City, NC].

**Status:** ⚠️ **ATTORNEY REVIEW REQUIRED** | Finalize structure and liability caps before launch.

Final Recommendations & Next Steps

Executive Recommendation: PROCEED with Lean Startup Model

Decision: Clipped is technically feasible, strategically positioned, and financially viable.

- Initial Capital: $150k self-funded (Mira or angel)

- Break-Even: Month 18 (July 2027) with conservative scenario

- Funding Strategy: Friends & Family ($250k) if 3 customers by Month 8

- Exit Path: Profitable standalone (Year 2=$420k profit) or Series A (Year 3=$1.5M+ profit)

- **Next 3 weeks:** Complete 15–20 discovery interviews. Lock 10 pilot LOIs.

- **Pricing validation:** Test $\$1, 500$–$\$2, 500$/seat/year pricing.

- **Pilot recruitment:** Identify 3–5 customers ready for Jan 2026.

- **Sales narrative:** "Real-time AI coaching for every SDR"

- **Launch messaging:** Prepare case studies & success metrics

- **Team building:** Hire 0.5 FTE CSM by Jan 2026

- **By Jan 15:** Finalize technical architecture & infrastructure plan (Shifted from Dec 20)

- **By Jan 20:** Sign vendor work-for-hire agreement (720 hours, $\$150$/hr, IP to Mira) (Shifted from Dec 23)

- **By Jan 23:** Begin Phase 1A development. Weekly technical standups with Mira. (Shifted from Jan 2)

- **Latency obsession:** $<1.5$s end-to-end latency=competitive moat; continuous performance testing

- **Security & Compliance by Day 1:** Build AES-256 encryption, deletion workflows, audit logging into MVP

- **Testing rigor:** 80\% unit test coverage, 100+ concurrent call load tests, chaos engineering

- **Deliverable focus:** 4 phases of engineering work (Phases 0-3) with clear acceptance criteria

- **Weekly sync:** Mon/Fri technical + business reviews (30 mins each) — Venko updates engineering progress

- **Go/No-Go gates:** Mar 1 (MVP complete), Apr 7 (Pilots active), Apr 30 (Conversion) — Venko responsible for technical readiness (Dates shifted)

- **Customer obsession:** Weekly pilot feedback loops; Mira gathers requirements, Venko implements rapidly

- **Vendor alignment:** Signed work-for-hire contract, IP ownership clear, SLAs documented

- **Financial discipline:** Monthly Venko invoicing ($\$10$–$\$20$k/month based on phase), Mira operational costs separate ($\$5$–$\$10$k/month)

| Milestone | Target | By When | Owner (Mira / Venko / Shared) |

|---|---|---|---|

| Discovery complete | 15+ interviews, 10 LOIs, pricing validated | Jan 20, 2026 | Mira |

| MVP core complete | Chrome ext, STT, AI, latency $ <1.5$s, all diagrams | Mar 1, 2026 | Venko (Engineering Vendor) |

| Pilot cohort 1 active | 5–7 customers, 50–70 SDRs, $>60$\% adoption | Mar 15, 2026 | Mira (Operations), Venko (Support) |

| Pilot conversion | 2–3 customers $\to$ paid, $\$30$–$\$60$k ARR | Apr 30, 2026 | Mira (Sales/CS) |

| Production launch | GDPR/SOC 2 audit, support infrastructure | Jul 30, 2026 | Venko (Tech), Mira (Ops/Legal) |

| Year 1 close | 5 customers, $\$120$k ARR, positive sentiment | Dec 31, 2026 | Mira (CEO) with Venko support |

| Break-even | Monthly revenue $>$ monthly costs | Jul 2027 | Mira (CEO) |

| Year 2 milestone | 15+ customers, $\$600$k ARR, $\$420$k profit | Dec 31, 2027 | Mira (CEO) with potential Venko ongoing support |

- **Mira:** Schedule 15–20 discovery interviews with SDR managers/founders (Jan 2–Jan 20) (Dates shifted)

- **Venko:** Finalize technical architecture, review all 8 technical diagrams, confirm infrastructure plan (By Jan 15)

- **Mira & Venko:** Identify startup-friendly attorney, draft work-for-hire vendor agreement, review NDA

- **Mira:** Confirm funding ($\$240$k Year 1 or bootstrap with $\$150$k self-funded)

- **Mira & Venko:** Schedule weekly technical sync (Mon 10 AM ET, Fri 2 PM ET, ongoing through 2026)

- **Venko:** Confirm all 3rd-party vendor agreements (Deepgram, OpenAI, AWS) ready for signature by Jan 20) (Date shifted)

19.1 Post-Vendor Technical Leadership & Handover

- Missing: A formal plan for hiring a permanent CTO/Lead Engineer (not a contractor) to take over the IP and infrastructure from Venko upon contract completion (Month 4).

- Action: Develop a detailed job description and begin recruitment by **Month 4 (April 2026)** to ensure seamless transition and reduce long-term dependency risk. (Date shifted)

19.2 Intellectual Property (IP) Defensibility Strategy

- Missing: A specific plan to protect the unique **Real-Time AI Prompting Methodology** (Diagram 2 in Tab 4) via patent.

- Action: Attorney must assess the patentability of the core real-time architecture and file a **provisional patent application** by **Month 7 (July 2026)** to establish a date of invention and create a competitive moat against Gong/Chorus. (Date shifted)

19.3 AI Governance and Ethics Policy

- Missing: An internal policy to manage risks associated with algorithmic bias (e.g., bias against accents/dialects in STT/AI) and model opacity.

- Action: Implement a mandatory internal **AI Bias Testing Protocol** and define thresholds for human review of AI coaching outputs by **Month 8 (August 2026)** to ensure fairness and compliance. (Date shifted)

19.4 Advanced Pricing & Monetization Strategy

- Missing: Pricing tiers currently rely solely on seat counts. Future growth will require monetizing consumption.

- Action: Model new pricing tiers based on a **Value Metric** (e.g., "AI Call Coaching Minutes Consumed" or " Number of Prompts Delivered") and plan to introduce this consumption-based model in **Year 2**.

19.5 Multi-State Call Recording Compliance Checklist

- Missing: While the MSA shifts responsibility to the customer, providing them with a **compliance guide** is crucial for retention and risk management.

- Action: Develop a **Multi-State Call Recording Matrix** that highlights the 11+ two-party consent states (e.g., CA, IL, PA) versus the one-party consent states (like NC) for sales enablement by **Month 5 (May 2026)**. (Date shifted)

11. Stress Test & Reality Check (The "No Fluff" Analysis)

Objective: Identify the 5 most likely failure points (Technical, Legal, & Operational) and how we prevent them.

The Risk: Google Chrome Store review times can spike (weeks/months) or policies can change, blocking the extension. Impact: 100% of user base locked out.

The Mitigation:

- Phase 1.5 (Sidebar Web-App): We are building a standalone "Sidebar" web version that works without the extension (using floating window). This is our "Emergency Hatch."

- Manifest V3 Compliance: Code is being written strictly to new V3 standards to avoid deprecation issues.

The Risk: Real-time transcription has a 2-3 second delay. If the rep moves on before the AI prompt appears, the advice is useless.

The Mitigation:

- "Optimistic UI": The UI will display "Listening..." markers so the rep knows help is coming.

- Async Processing: We are using a detached worker thread for API calls so the browser never freezes.

The Risk: Recording voice prints in states like Illinois (BIPA) or Texas without strict consent leads to massive class-action lawsuits.

The Mitigation:

- Geo-Blocking (Initially): We will disable recording features for IP addresses in IL/TX until legal review is complete.

- "Consent First" UX: The rep CANNOT record until they check a box confirming they have informed the other party.

- Legal Buffer: We allocated $8, 000 specifically for a BIPA compliance audit.

The Risk: Sales reps hate "Big Brother." They might feed the AI bad data or refuse to use it.

The Mitigation:

- "Gamification": Reps get points/badges for "Coachable Moments" found by AI.

- Manager-Only View: We will limit "Performance alerts" to managers to prevent rep anxiety, focusing rep view on "Help," not "Judgment."

The Risk: An infinite loop or a "Chatty Cathy" rep could burn through $5, 000 of OpenAI credits in a week.

The Mitigation:

- Rate Limiting: Hard cap of $10/user/month on API calls.

- Caching: If the AI sees a similar conversation, it re-uses the old prompt instead of paying for a new one.

- The $15k Buffer: We have a specific "API Overage" fund in the bank.

✅ Stress Test Action Checklist

To survive these scenarios, we must verify the following before Day 1 of coding:

- [] Tech: Confirm "Sidebar Web-App" is explicitly in Phase 1.5 specs (Emergency Hatch).

- [] Legal: Verify "Geo-Blocking" logic for IL/TX is in the MVP requirements.

- [] Finance: Open separate "API Overage" bank account with $15k reserve.

- [] UX: Approve "Consent First" checkbox wireframes for dialer.